India’s UPI (Unified Payments Interface) has taken the world by storm. It’s fast, free, and widely used — from small shops to big businesses. With the rest of the world praising this system, one question naturally pops up: Why hasn’t the United States – a global tech leader – adopted something like UPI yet?

💡 Understanding UPI: India's Digital Payment Marvel

Unified Payments Interface (UPI) has transformed India’s payment landscape. Launched in 2016, UPI enables instant, real-time bank-to-bank transactions using mobile devices. It’s free, operates 24/7, and has been widely adopted across India, from metropolitan cities to rural areas.

🤔 Why Doesn’t the U.S. Have Something Like UPI?

It’s surprising, right? The world’s largest economy, but still behind when it comes to real-time, no-fee, peer-to-peer payments. Here’s what’s going on 👇

🏦 What Payment Systems Does America Use Right Now?

- Zelle – Real-time bank transfers but limited to participating banks.

- Venmo & Cash App – Fast, popular, but not universal. Often charge fees.

- Apple Pay / Google Pay – Work through cards, not linked to bank-to-bank like UPI.

- ACH (Automated Clearing House) – Common for bill payments. Slow. Takes 1–3 days.

- Wire Transfers – Expensive. Used for large payments only.

🧑💻Why the U.S. Is Hesitant to Adopt UPI Like System

1. Credit Card Culture Run Deep

America is heavily credit-driven. Most people use credit cards — and banks earn big from interchange fees (merchant fees) and interest.

👉 UPI kills this model. It’s free and direct.

2. Bank Lobbying

Big banks and card networks like Visa and Mastercard have massive influence. Why would they want a free payment system that cuts them out of the profits?

3. Fragmented Infrastructure

Unlike India’s UPI, built by a centralized body (NPCI) under the government, the U.S. has no single digital payment backbone. Every provider builds their own.

🏛️ Is the U.S. Government Anti-UPI?

Not exactly. But it’s not pushing for something UPI-like either.

Instead of building a public payment rail, the U.S. launched FedNow in July 2023 — a 24/7 real-time payment system developed by the Federal Reserve. Sounds promising?

Well… kind of.

FedNow is B2B focused initially

Only 35+ banks joined in the first launch phase

Not everyone can use it yet

Still relies on banks to offer access

👉 Unlike India’s UPI, there’s no government-run system. There’s no “Paytm” or “PhonePe” equivalent pushing FedNow to the public.

📈 Is There a Future UPI-Alternative Coming to the U.S.?

As of now:

No official move to adopt India’s UPI

No clear public plan to create a free, universal payment rail like UPI

FedNow is a baby step, but consumer rollout is slow

😠 Why Is No One Taking Initiative?

Because nobody wants to kill the golden goose.

-

Banks don’t want free transfers to take over

-

Credit card companies don’t want to lose swipe fees

-

Even platforms like Venmo and Cash App earn via fees or investing idle balances

And since consumers are used to the system, there’s no public pressure like India had during demonetization in 2016, which indirectly boosted UPI adoption.

🌎 Are Other Countries Embracing UPI?

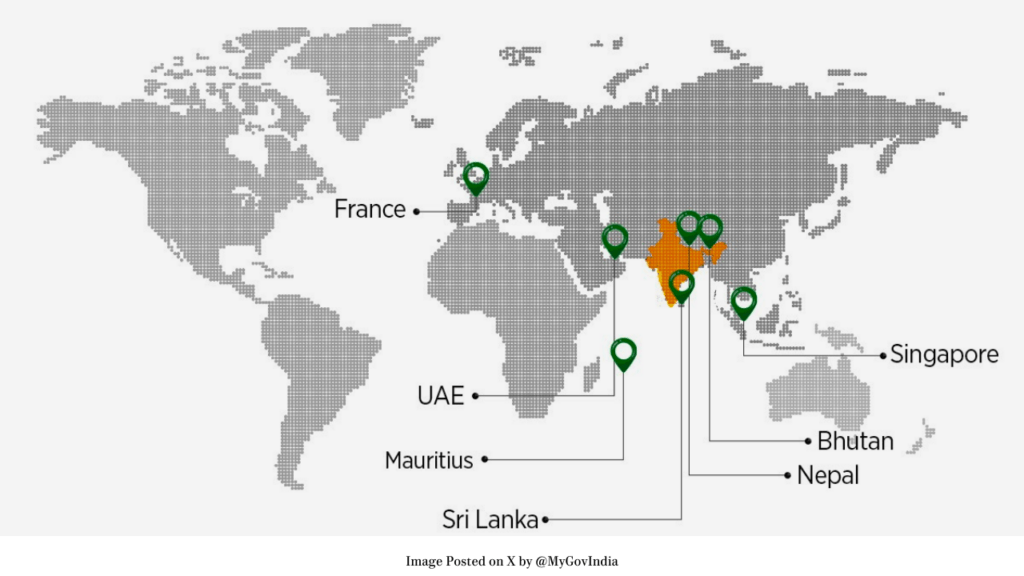

Yes! Countries like France, UAE, Singapore, Bhutan, and Sri Lanka are actively adopting UPI or collaborating with India.

Ironically, the U.S. – known for innovation – is falling behind in this global digital payment race.

🚨 Final Thoughts: Is This Daylight Robbery?

Yes — kind of.

While Indians scan QR codes and pay instantly with zero fees, Americans are often:

-

Paying 2.9%+ to send money

-

Waiting days for transfers

-

Paying banks and apps for services that are free elsewhere

It’s not about tech — it’s about business models and who profits.

What do you think? Let me know in the comments!