The U.S. dollar has been the king of currencies for decades. Whether you’re buying oil, trading gold, or doing international business — chances are, the dollar’s involved.

But lately, a group of countries called BRICS is making moves to shake things up. They’re building a system that could one day replace the U.S. dollar.

Is it just a bold dream? Or Can BRICS replace the dollar?

Let’s break it down.

🌍 First, What Is BRICS?

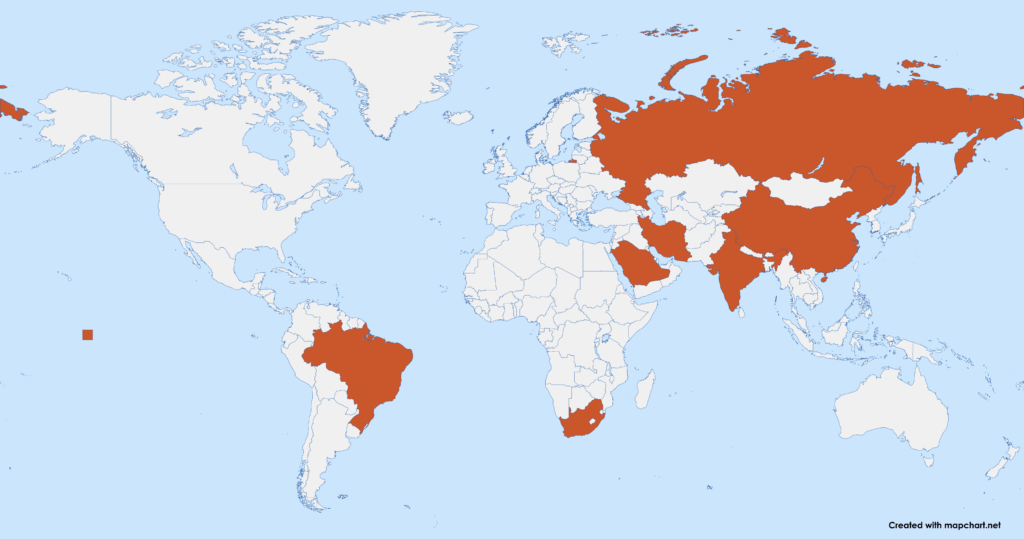

BRICS stands for Brazil, Russia, India, China, and South Africa — five fast-growing economies that teamed up to work on trade, politics, and financial independence.

Together, they represent:

40%+ of the world’s population

Around 25% of global GDP

After 2024 summit, Over 30 countries expressed interest in joining BRICS

Nations like Iran, Egypt, Ethiopia, and Argentina are already new members (BRICS just became BRICS+)

Their big idea? Stop depending on the dollar and start doing business on their own terms.

💳 Why BRICS Wants to Ditch the Dollar

Right now, the U.S. dollar dominates international trade. Even countries outside the U.S. rely on it for buying oil, paying off debt, or storing reserves.

But this comes with a catch:

⚠️ It’s No Longer Backed by Gold — Just Trust

Back in the day, every dollar had gold behind it. That ended in 1971. Since then, it’s just… paper. Valuable? Yes — but only because people believe in it. That’s a shaky foundation for a global economy.

⚠️ The U.S. Prints Dollars Like It’s Free

When America needs money, it simply prints more. Since dollar is used worldwide it casuses global inflation But this creates inflation.

⚠️ Too Much Power in One Country’s Hands

Because the world uses dollars, the U.S. gets to call the shots. It can freeze transactions, block countries from global systems, or impose sanctions at will. Russia felt this hard — and other nations took notes.

⚠️ Oil Deals Keep the Dollar in Power

Why is everyone still using the dollar? Largely because of oil. Most oil is sold in dollars, thanks to old agreements with countries like Saudi Arabia. That’s what built the “petrodollar” system — and kept the dollar essential.

⚠️ It’s Risky to Rely on Just One Currency

If the U.S. economy crashes or faces a major crisis, the entire world feels it. That’s a huge risk. No one likes putting all their eggs in one basket — especially not entire countries.

🧾 What Has BRICS Done So Far?

They’re not just talking. Here’s what’s already in motion:

🔸 BRICS Pay

A payment system launched to make cross-border payments easier among BRICS countries — without needing U.S. dollars. Think of it like UPI, but for international trade.

🔸 A Common BRICS Currency?

There’s growing buzz around a new BRICS currency that could eventually rival the dollar. Some reports say it could be backed by gold or a mix of commodities.

No launch date yet — but discussions are getting serious, especially after the 2024 BRICS Summit in Russia

🚨 Why Isn’t the U.S. Panicking?

So far, the U.S. is watching quietly. No major reactions. No public warnings.

Why?

Because the dollar still controls:

58% of global foreign reserves

88% of global forex transactions

Almost all major oil trades

Plus, creating a stable global currency isn’t easy. Even BRICS members like India and Brazil are still being cautious — they don’t want to rush into something that could mess with their own economies.

🧐 Can BRICS Really Replace the Dollar?

Short answer: Not anytime soon.

But in the long run? Maybe.

They’ll need to:

Create trust in their currency

Build a strong payment system

Avoid infighting and political differences

Convince other countries to actually use it

That’s a long road — but not impossible.

🔮 What Happens If BRICS Succeeds?

If BRICS pulls this off, we could see a:

More balanced global economy

Reduced U.S. influence in global finance

More trade between developing countries

US economy takes a big hit

But it could also create new tensions, shake up markets, and lead to major changes in how the world does business.

✍️ Final Thoughts

BRICS isn’t just a buzzword anymore. It’s a serious movement — one that’s trying to challenge a system that’s been in place since World War II.

Replacing the dollar? That’s a massive task. But BRICS is laying the foundation brick by brick.

Keep an eye on this — because if it succeeds, it could reshape the world economy as we know it.